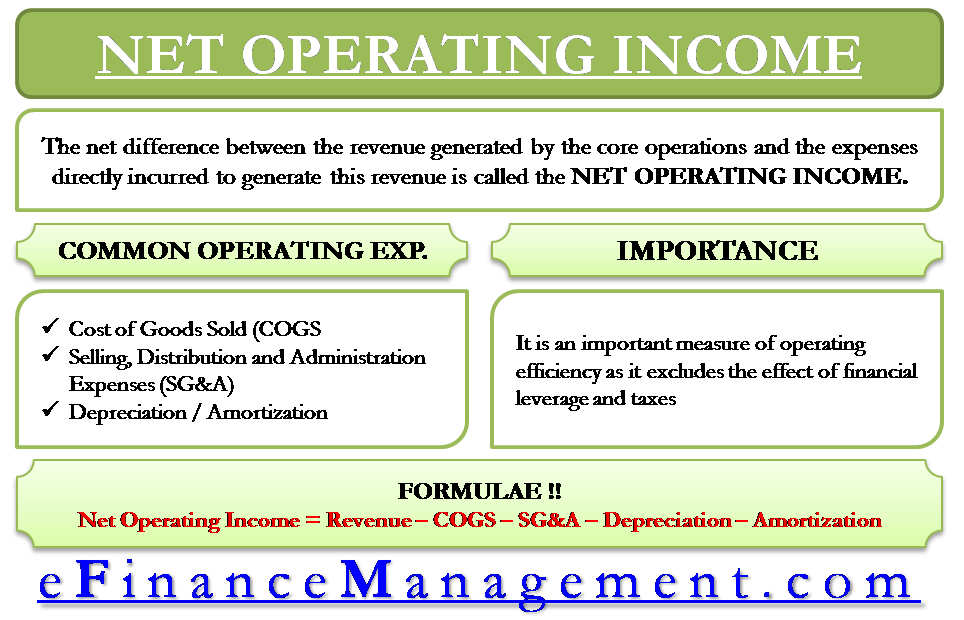

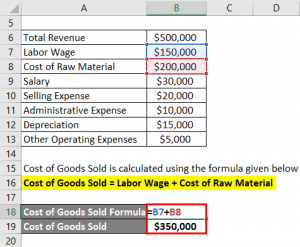

With NOI, more line items are excluded to capture property-level profitability, such as SG&A.įor real estate properties, NOI accounts for the lost revenue caused by tenant vacancies, while EBITDA does not. EBITDA: On the other hand, EBITDA is used to measure the profitability of a company as a whole.Īnother difference between the two relates to what is excluded when calculating each measure.NOI: Given the property-specific nature of NOI, it is usually used to measure the profitability of a property, whether it be commercial or residential.The major difference is the use case of each metric. While both NOI and EBITDA are two commonly used measures of profitability that exclude the effects of certain non-operating expenses, there are some key differences between the two. EBITDA = Net Income + Interest + Taxes + Depreciation + Amortization.EBITDA = Operating Income + Depreciation + Amortization.When comparing companies, investors will often use EBITDA as the metric of comparison as opposed to net income, given that EBITDA eliminates the effects of certain non-operating items that may be the result of accounting decisions or financing provisions.ĮBITDA is found by taking a company’s earnings before interest and taxes, also known as operating income, and then adding back depreciation and amortization. However, investors will almost always use a company’s GAAP measures to determine EBITDA, given the metric’s usefulness in assessing profitability. Since it is a non-GAAP measure of profitability, companies are not required to report EBITDA on their financial statements. Learn More → Net Operating Income (NOI) EBITDA DefinitionĮBITDA measures a company’s profitability before the effects of certain accounting or financial decisions. NOI = Rental and Ancillary Income – Direct Real Estate Expenses.NOI can be calculated using the following formula. As you can see, the net income equation is. All revenues and all expenses are used in this formula. Many different textbooks break the expenses down into subcategories like cost of goods sold, operating expenses, interest, and taxes, but it doesn’t matter. NOI eliminates the effects of these corporate-level expenses by isolating the core operating profits of the real asset in question, namely by excluding non-operating items such as depreciation, interest, taxes, corporate-level SG&A expenses, CapEx, and financing payments. The net income formula is calculated by subtracting total expenses from total revenues. Since NOI allows an investor to gauge the profitability of a real asset and eliminate the effects of corporate-level expenses, this metric is often considered the most important profitability measure in real estate.

NOI is a real estate metric that stands for “net operating income” and measures the profitability of an income-generating real asset. EBITDA: What is the Difference? Net Operating Income Definition (NOI) NOI and EBITDA are two similar measures of profitability in real estate with some key differences.

0 kommentar(er)

0 kommentar(er)